The manufacturing sector is currently undergoing a massive transformation often termed Industry 4.0. At the heart of this revolution lies connectivity. For decades, industrial environments have relied on wired Ethernet or standard Wi-Fi to connect machines, sensors, and workers. However, as factories become “smart” ecosystems driven by artificial intelligence (AI), massive Internet of Things (IoT) deployments, and autonomous mobile robots (AGVs), legacy networks are hitting a breaking point. The solution that is rapidly gaining traction among top-tier enterprises is the Private 5G Network.

- The Rise of Private 5G in Industrial Automation

- Why Manufacturing Needs Private 5G: The Business Case

- 1. Deterministic Latency and Reliability

- 2. Massive Device Density (mMTC)

- 3. Enhanced Security and Data Sovereignty

- 4. Mobility for Autonomous Systems

- Private 5G vs. Wi-Fi 6: A Technical Comparison

- Key Use Cases for Private 5G in Smart Factories

- Implementation Guide: Building Your Private 5G Network

- Phase 1: Spectrum Strategy

- Phase 2: Architecture Selection

- Phase 3: Hardware and Vendor Selection

- Phase 4: Integration and Security

- Cost Analysis and ROI

- Top Private 5G Vendors and Providers

- Cybersecurity in Private 5G Environments

- Future Outlook: Toward 6G and AI-Native Networks

- Summary Checklist for Deployment

This comprehensive guide explores the implementation of Private 5G in smart manufacturing. We will cover technical architecture, cost-benefit analysis, comparison with Wi-Fi 6, and a step-by-step deployment roadmap. This content is designed for CTOs, network architects, and plant managers looking to future-proof their operations with high-performance, low-latency wireless infrastructure.

The Rise of Private 5G in Industrial Automation

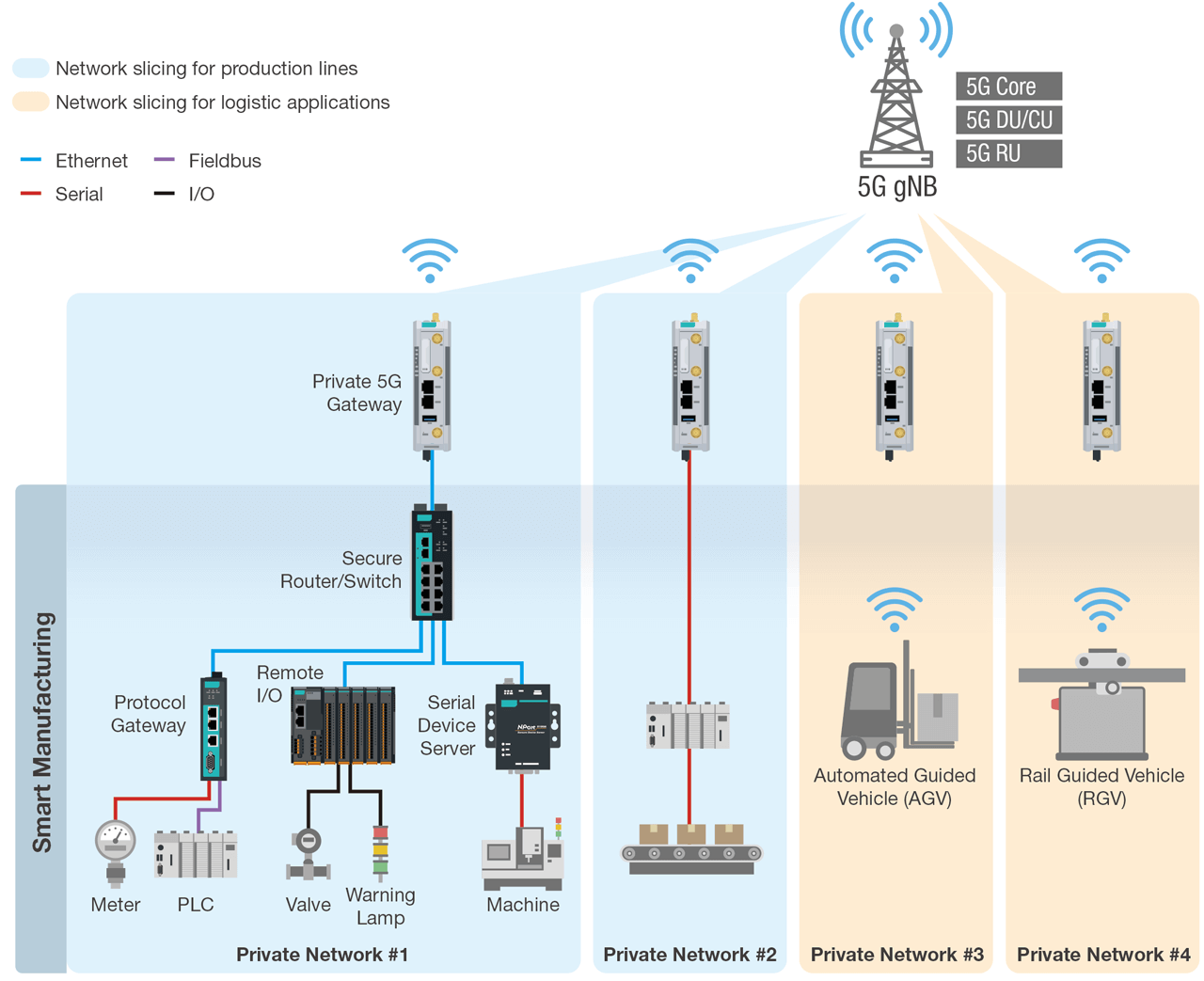

A Private 5G network (P5G) is a dedicated cellular network deployed for a specific enterprise, offering unified connectivity with optimized services. Unlike public 5G networks, which are shared by millions of subscribers, a private network allows the organization to control every aspect of the infrastructure, from security policies to resource allocation.

Recent market data from late 2024 and forecasts for 2025 indicate explosive growth in this sector. Analysts predict the private 5G market will grow from approximately $2.31 billion in 2024 to over $3.22 billion in 2025. This surge is driven by the need for ultra-reliable low-latency communication (URLLC) which is essential for mission-critical industrial applications.

Source: EIN Presswire – Private 5G Device Market Trends 2025-2029

Why Manufacturing Needs Private 5G: The Business Case

The decision to transition from Wi-Fi or wired connections to Private 5G is driven by specific operational bottlenecks that standard connectivity cannot solve.

1. Deterministic Latency and Reliability

In a smart factory, a delay of milliseconds can disrupt a synchronized assembly line or cause a safety hazard with robotic arms. Public networks and Wi-Fi utilize “best-effort” delivery. Private 5G offers deterministic latency, often under 10 milliseconds, and “six nines” (99.9999%) reliability. This ensures that control signals reach equipment instantly and consistently, which is a requirement for precision manufacturing.

2. Massive Device Density (mMTC)

Modern factories are deploying thousands of sensors to monitor temperature, vibration, and performance data. This is known as Massive Machine Type Communication (mMTC). Wi-Fi access points typically degrade in performance when handling hundreds of concurrent connections. 5G is architected to support up to one million devices per square kilometer, allowing for granular visibility without network congestion.

3. Enhanced Security and Data Sovereignty

Data security is paramount in manufacturing to protect intellectual property and operational integrity. With a private 5G network, data never leaves the facility’s premise. It does not traverse the public internet or a carrier’s core network. This “data sovereignty” reduces the attack surface and allows IT teams to implement zero-trust security architectures directly at the cellular level.

4. Mobility for Autonomous Systems

Autonomous Guided Vehicles (AGVs) and mobile robots require seamless handover between access points as they move across large factory floors. Wi-Fi handovers can cause packet loss or latency spikes, leading to AGVs stalling or safety stops. 5G handles mobility seamlessly, allowing robots to move at speed without losing connectivity.

Private 5G vs. Wi-Fi 6: A Technical Comparison

Many decision-makers ask if Wi-Fi 6 (or 6E) is sufficient. While Wi-Fi 6 is a powerful technology, it serves a different purpose than Private 5G in an industrial context.

Interference and Spectrum:

Wi-Fi operates in unlicensed spectrum (2.4GHz, 5GHz, 6GHz), which is prone to interference from neighboring networks and heavy machinery. Private 5G often utilizes licensed or shared spectrum (like CBRS in the United States or localized industrial spectrum in Germany and Japan). This guarantees a clean signal free from external noise.

Coverage:

A single 5G small cell can cover a significantly larger area than a Wi-Fi access point. For large warehouses or outdoor storage yards, 5G requires fewer infrastructure nodes, reducing cabling and installation costs.

Quality of Service (QoS):

5G allows for Network Slicing. This means you can create a virtual “slice” of the network dedicated solely to safety systems, guaranteeing them bandwidth even if the rest of the network is congested with video downloads. Wi-Fi lacks this granular level of traffic prioritization.

Key Use Cases for Private 5G in Smart Factories

Digital Twins

A digital twin is a virtual replica of a physical system. To maintain a real-time digital twin, factories must stream terabytes of data from physical machines to the digital model. The high uplink throughput of 5G makes this possible, enabling predictive maintenance simulations that save millions in downtime.

Augmented Reality (AR) for Maintenance

Field technicians are increasingly using AR headsets to overlay schematics and repair instructions onto physical machines. This requires high bandwidth video streaming and low latency to prevent motion sickness. Private 5G provides the “fat pipe” needed for these immersive experiences.

Vision-Based Quality Control

High-definition 4K cameras can inspect products on a conveyor belt in real-time, using AI to detect defects invisible to the human eye. This generates massive amounts of data that must be processed at the edge. 5G’s high bandwidth capability ensures these video streams are transmitted without compression artifacts that could confuse the AI.

Implementation Guide: Building Your Private 5G Network

Deploying a private cellular network is complex. It involves spectrum acquisition, hardware procurement, and integration. Here is a high-level roadmap.

Phase 1: Spectrum Strategy

The first step is securing the radio waves.

- Licensed Spectrum: Leased from mobile network operators (MNOs). High cost but guarantees no interference.

- Shared Spectrum (CBRS): In the US, the Citizens Broadband Radio Service (CBRS) allows enterprises to use the 3.5 GHz band without an expensive license. This has been a major driver of Private 5G adoption.

- Local Industrial Licenses: Countries like Germany (3.7-3.8 GHz) and the UK offer spectrum specifically dedicated to industrial verticals.

Phase 2: Architecture Selection

- Standalone (SA) 5G: The most advanced form. It uses a 5G core and 5G radio. It offers the full benefits of slicing and ultra-low latency.

- Non-Standalone (NSA): Uses 5G radios but relies on a 4G LTE core. It provides faster speeds but lacks the advanced latency features of SA. Most new industrial deployments in 2025 are choosing Standalone 5G.

Phase 3: Hardware and Vendor Selection

You will need a Radio Access Network (RAN) comprising small cells and a Core Network.

- Radio Units: These transmit the signal. Vendors include Ericsson, Nokia, and Samsung.

- Core Network Software: The “brain” of the network. This can run on-premise servers or in the cloud. Players like Cisco, Microsoft Azure Private 5G Core, and AWS Private 5G offer managed services that simplify this layer.

- User Equipment (UE): The modems and dongles that connect your machines to the 5G network.

Source: Frost & Sullivan – Private 5G Network Market Global 2025-2029

Phase 4: Integration and Security

The network must integrate with your existing Operational Technology (OT) and Information Technology (IT) systems. This includes firewalls, Identity and Access Management (IAM), and ERP systems. A key challenge is ensuring that legacy machines (using protocols like Modbus or Profinet) can communicate over the 5G network, often requiring industrial gateways.

Cost Analysis and ROI

The cost of Private 5G has decreased significantly. Solutions like “Network-as-a-Service” (NaaS) allow companies to pay a subscription fee rather than a massive upfront CAPEX.

Cost Components:

- Small Cells: $2,000 to $10,000 per node depending on power and ruggedization.

- Core Software: Often licensed annually.

- Spectrum Access System (SAS) Fees: For CBRS users, a small monthly fee per device.

- Integration Services: Professional fees for site surveys and configuration.

Return on Investment:

ROI is typically achieved through efficiency gains.

- Reduction in unplanned downtime: Just 1 percent improvement can save millions in automotive or semiconductor manufacturing.

- Faster reconfiguration: Moving a production line connected via 5G takes hours, not days, as there is no recabling required.

- Inventory accuracy: Real-time tracking of assets reduces loss and waste.

Source: UCtel – Cost and ROI of Deploying a Private 5G Network

Top Private 5G Vendors and Providers

The market is fragmented with different types of players.

Traditional Telecom Equipment Manufacturers:

- Nokia: A market leader with its Digital Automation Cloud (DAC). Nokia has extensive experience in industrial verticals.

- Ericsson: Offers the “Private 5G” product, known for high reliability and carrier-grade hardware.

Hyperscalers (Cloud Providers):

- AWS Private 5G: Amazon offers a simplified simplified deployment model where they ship the hardware and you manage it via the AWS console. This is ideal for enterprises already deep in the AWS ecosystem.

- Microsoft Azure: Focused on the “Edge,” integrating Private 5G Core with Azure Edge Zones for low-latency compute.

Enterprise Networking Giants:

- Cisco: Leveraging their enterprise dominance, Cisco offers Private 5G as a managed service, integrating tightly with existing enterprise Wi-Fi and security policies.

- Celona: A pioneer in “edgeless” enterprise 5G, utilizing the CBRS band to make deploying 5G as easy as deploying Wi-Fi.

Source: Innova News – Top 7 Private 5G Network Providers

Cybersecurity in Private 5G Environments

While Private 5G is inherently secure, it is not immune to threats. The convergence of IT and OT introduces new risks.

- SIM Management: Physical SIM cards can be stolen. eSIMs are preferred for industrial devices to prevent tampering.

- Rogue Base Stations: Attackers could theoretically set up a fake cell tower. Mutual authentication protocols in 5G SA help mitigate this.

- Supply Chain Risk: Ensure hardware vendors comply with national security standards and supply chain transparency.

The “Zero Trust” model is essential here. Every device, whether a temperature sensor or a robotic arm, must be authenticated and authorized before it can send data.

Future Outlook: Toward 6G and AI-Native Networks

As we move toward 2030, Private 5G will evolve. The 3GPP Release 18 (5G Advanced) introduces even better positioning accuracy (down to centimeters) and energy efficiency. Eventually, 6G will integrate communication with “sensing,” allowing the network itself to detect the presence of objects without them needing a sensor attached.

For now, the focus for manufacturers is on deploying stable, scalable 5G Standalone networks that provide the backbone for the factory of the future. The companies that invest in this digital foundation today will have a significant competitive advantage in agility and efficiency tomorrow.

Summary Checklist for Deployment

- Define Use Cases: Don’t buy technology for technology’s sake. Identify the pain point (e.g., AGV connectivity).

- Conduct a Site Survey: Understand the radio frequency environment of your factory. Metal structures reflect signals; this must be modeled.

- Choose Spectrum: Decide between CBRS, licensed, or local industrial spectrum.

- Select a Partner: Few manufacturers can do this alone. Choose a systems integrator with OT experience.

- Start Small: Run a pilot in one section of the floor before a full rollout.

By following this strategic approach, manufacturers can unlock the full promise of Industry 4.0, transforming their operations into intelligent, data-driven powerhouses.